In 1992, Cabot LNG signed an MOU with National Gas Company of Trinidad and Tobago, Amoco and British Gas plc to initiate a feasibility study for the Atlantic LNG project. On July 20, 1995, The Atlantic LNG Company of Trinidad and Tobago was founded by the 4-way partnership, which popularly came to be known as the “The Trinidad Model”. Cabot agreed to purchase LNG for a period of 20 years and AMOCO Trinidad Oil Company in return agreed to supply gas to facilitate its liquefaction. The project also signed a long-term SPA with Enagas. At the time, British Gas’ only presence in LNG was as a ship owner while Amoco and NGC had no LNG experience. Coming into the project with an ‘outside’ perspective, allowed the companies to bring several commercial innovations to the project such as sales Contracts that allowed switching of destinations and a competitive “dual FEED” strategy that helped reduce project EPC costs significantly. With an intent to sell the LNG predominantly to a lower priced US market, the commercial innovations were critical to making the project viable.

Within a year, construction was initiated to build a single train LNG plant on reclaimed land at Point Fortin. The plant would be a purely processing operation and would export LNG and natural gas liquids (NGLs) using supply from offshore fields north and east of Trinidad. Construction took about 3 years, with first cargo being shipped to Boston in May 1999. The plant became not only the second ever LNG plant in the Western Hemisphere, but also the second ever plant to use the Phillips Petroleum Co.’s (later ConocoPhillips) Optimized Cascade process in the over 35-year long history of LNG.

The success of the project triggered off expansion plans almost immediately after operations commenced. In March 2000, Atlantic LNG and the Government of Trinidad and Tobago agreed to add 2 additional trains of capacity 3.30 MMTPA and 6,000 bpd of natural gas liquids (NGLs). Trains 2 and 3 commenced commercial operations in August 2002 and April 2003 respectively. The momentum continued with the construction of the fourth train starting in 2003. In December 2005, Atlantic LNG showcased production from the largest train in the world of its time, with a capacity of 5.20 MMTPA of LNG.

By 2014, Atlantic LNG had already dispatched 3000 shipments. The project, with a fleet of 27 GE Frame 5 turbine driven compressors, prides itself as the largest Frame 5 fleet in the world.1 The facility also boasts of an industry-leading safety record of 35 million manhours without a Lost Time Injury (LTI).2 Over 650 full time personnel are employed by Atlantic LNG, 98% of which are nationals of Trinidad and Tobago. In addition, over 1000 contractors are engaged in the maintenance of the facility.

Atlantic LNG’s sustainability programmes are aimed at creating far reaching opportunities and long-term impact in the local and national community in various areas, including Sports, Education, Local Economic Development and Environment. The initiatives include the Atlantic Coaching Excellence (ACE) Programme for training coaches at the primary school level, the Atlantic National Energy Skills Centre (NESC) for technical and vocational skills training, Point Fortin’s Finest scholarship programme, the Atlantic/IDB Local Economic Development (LED) Programme for building capacity and development opportunities, as well as sports programs ranging from Cricket and Soccer to Track & Field, Swimming and Tennis. Atlantic LNG also collaborates with the Fondes Amandes Community Reforestation Programme and the National Sea Turtle Tagging and Monitoring Programme.3

OWNERSHIP (Equity %)

| Train 1 | |

| Royal Dutch Shell | 46.00% |

| BP Trinidad LNG B.V. | 34.00% |

| China Investment Corporation (CIC) | 10.00% |

| NGC Trinidad and Tobago | 10.00% |

| Trains 2 & 3 | |

| Royal Dutch Shell | 57.50% |

| BP Trinidad LNG B.V. | 42.50% |

General Data

| Estimated Capital Cost (USD) | 2.2 B |

| Plant Type | Onshore Stick-built |

| Plant Stage | Operating |

| Final Investment Decision (FID) Year | Train 1 – 1995 Trains 2 & 3 - 1996 |

| FEED Contractor | Bechtel |

| EPC Contractor | Bechtel |

| No. of Trains / capacity | 3 Trains / 3.3 MMTPA each (Train 1 upgraded from 3.0 MMTPA) |

| Production Start Year | Train 1 – 1999 Train 2 – 2002 Train 3 – 2003 |

| Products | LNG, Propane, Butane, Condensate |

| Gas Type | Non-associated Gas (NAG) |

Technical Data

| Cooling Media | Air |

| Liquefaction Technology | CoP Optimized Cascade® |

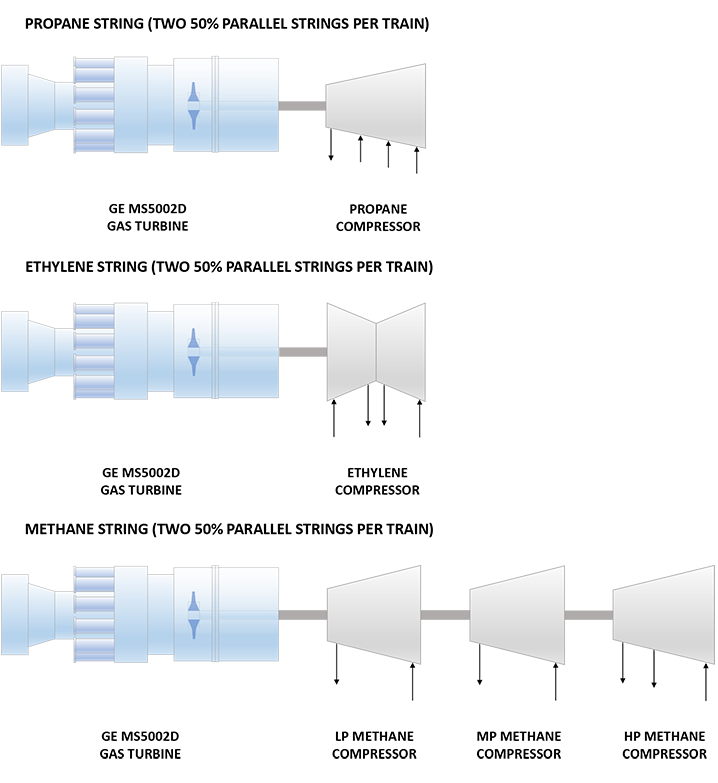

| Refrigeration Train Details: | |

| Propane Strings 1 & 2 | |

| Driver | GE MS5432D (Frame 5D) Heavy Duty Gas Turbine (Train 1 upgraded from GE MS53382C) |

| Propane Compressor | GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor |

| Ethylene Strings 1 & 2 | |

| Driver | GE MS5432D (Frame 5D) Heavy Duty Gas Turbine (Train 1 upgraded from GE MS53382C) |

| Ethylene Compressor | GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor |

| Methane Strings 1 & 2 | |

| Driver | GE MS5432D (Frame 5D) Heavy Duty Gas Turbine (Train 1 upgraded from GE MS53382C) |

| Low Pressure (LP) Methane Compressor | GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor |

| Medium Pressure (MP) Methane Compressor | GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor |

| High Pressure (HP) Methane Compressor | GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor |

| Power Generation | Train 1: 3 x Solar Mars 100 Gas Turbine Generators Trains 2 & 3: 2 x Solar Mars 100 Gas Turbine Generators |

Refrigeration Train Configuration

Key Facts

- In the early to mid-90s, several attempts to launch LNG projects in the Atlantic Basin had failed. The Trinidad & Tobago government has been credited with contributing to Atlantic LNG’s success by its creation of a political and economic environment for the project that compared favorably with that faced by its competitors, from its attitude towards outside investment to its political stability.4

- The reported cost of Train 1 and its associated facilities was US$965 million making it the largest single investment in the Caribbean Islands at the time. Train 1 was financed in part by shareholders, but largely through a US$600 million loan, US$391.4 million of which was guaranteed by U.S. Exim and $180 million by the World Bank’s OPIC. The company reported the cost of Trains 2 and 3 at US$1.1 billion, with the expansion shareholder financed.4

- LNG from Train 1 was sold on an FOB (free on board) basis based on two long-term (20-year) contracts. However, there was significant flexibility in the contracts that allowed for the switching of destinations. The elimination of strict destination restrictions, common in all LNG contracts up to that point, was a key selling point for Atlantic. Additionally, it decided to launch with just one train, something no LNG promoter had considered since Kenai.4

- For Atlantic LNG to be commercially feasible in the mid-1990s, cost reductions of 30-40% when compared to other LNG plants of the time were required. To drive down costs by creating competition, the project owners elected to pursue a “dual FEED” strategy. Two contractors, the first a JV of Chiyoda and Hudson Engineering and the second being Bechtel were selected to execute a parallel FEED competition. At the end of the FEED competition, Bechtel was awarded the EPC contract for Train 1.5

- The selection of Bechtel and the subsequent successful execution of the lower cost Atlantic LNG was a game changer for the LNG industry, in particular for Bechtel and the Phillips (now ConocoPhillips) Optimized Cascade liquefaction technology. After Kenai, 30 years had gone by without another project selecting the Cascade technology. However, soon after the success of Atlantic LNG Trains 1-3, Bechtel and the ConocoPhillips Optimized Cascade Technology were selected for a multitude of LNG projects including Egyptian LNG, Darwin LNG and Equatorial Guinea LNG.6

- For Atlantic LNG, the methane circuit of the Phillips Optimized Cascade process was modified from the closed loop circuit used in Kenai to an open loop circuit. The major advantage of this modification was that it eliminated the need for a separate fuel gas compressor. Also, boil-off gas and vapor return from tanker loading could be recovered and fed back to the liquefaction train for re-liquefication rather than being routed directly to fuel or flare.6

- The most significant design changes made to Trains 2 and 3 (compared with Train 1) were in the propane system, heavies end removal column system and the compressor drivers. Operability issues related to poor hydraulics in the propane system on Train 1 were corrected. GE Frame 5D turbines were used as compressor drivers instead of the Frame 5Cs used for Train 1 which directly resulted in incremental LNG production of almost 10%.7

- In 2003/04, all 6 Train 1 GE Frame 5C turbines were upgraded to Frame 5D to increase Train 1 LNG production by approximately 10%. At the same time, the ethylene compressors were re-bundled and a new third stage volute was added to the propane compressors of train 1.8

- In 2011/12, following corrosion and pitting degradation of axial compressor blades on several of Atlantic LNG’s Frame 5 drivers, the plant replaced the filter houses with high efficiency filter houses and new ventilation systems with separate inlets from GE Oil & Gas. 26 complete air intake systems in stainless steel were provided by Camfil Power Systems with E12 class filtration.9

- 2017 was a difficult year in terms of process safety for Atlantic LNG, with two significant incidents that year. The first was a gas release on Train 3 on August 2, and then in September there was a fire on one of the nine power generation units. Fortunately, there were no casualties or injuries in either incident.10

- Atlantic LNG developed a gantry-based system for the modular change out of their Frame 5D engines instead of the standard in-situ replacement during major overhauls. This modular approach was designed to save 12 days of downtime for a major overhaul which represented significant savings for the LNG plant given its fleet of 26 Frame 5Ds in continuous operation.11

- Over the years, Atlantic LNG has had multiple changes in ownership:

> The original ownership at the start of Train 1 in July 1995 was: AMOCO (46%), British Gas (34%), Cabot LNG (10%) and NGC (10%).12

> In late 1995, Repsol bought into the project with the new ownership being: AMOCO (34%), BG (26%), Repsol (20%), Cabot LNG (10%) and NGC (10%).12

> In December 1998, AMOCO was acquired by British Petroleum (BP) even before Train 1 came online, thus replacing AMOCO as Atlantic LNG’s 34% shareholder.13

> On March 13, 2000 Train 2 & 3 ownership was: BP (42.5%), BG (32.5%) and Repsol (25%).12

> Suez S.A., a French multinational corporation, was formed in 1997 by merging ‘Compagnie de Suez’ and ‘Lyonnaise des Eaux’. In July 2000, Tractebel, a unit of Lyonnaise des Eaux, acquired Cabot LNG from Cabot Corporation thereby acquiring a 10% stake in Atlantic LNG’s Train 1.14,15

> July 2008 witnessed the merger of Suez S.A. and Gaz de France to form GDF Suez.13

> Three years later in 2011, China Investment Corporation (CIC) purchased GDF Suez’s 10% interest in Train 1.16

> In 2014, Royal Dutch Shell plc acquired Repsol S.A.’s LNG portfolio outside North America.17

> In 2016, Shell officially acquired BG Group plc. As a result, Shell’s total ownership in Train 1 increased to 46% and its ownership in Trains 2 & 3 increased to 57.50%.18 - In June 2004, Atlantic LNG Train 3 was shut down due to an explosion on the sixth and final gas turbine to be worked on as the train was being restarted following routine maintenance. The company said that the explosion occurred within the exhaust stack and that the damage was localized, extending to the stack supports, roofing and fixtures in the area. 19

- The first use of vacuum jacketed pipe in an LNG Plant was at the Atlantic LNG Plant in Trinidad. 20

Source:

1. ‘Our Trains’, Atlantic LNG Website

2. ‘Atlantic at a Glance’, Atlantic LNG Website

3. ‘Sustainability – Society’, Atlantic LNG Website

4. Shepherd, R., Ball J. ‘Liquefied Natural Gas from Trinidad and Tobago: The Atlantic LNG Project‘, Working Paper #30, Geopolitics of Natural Gas Study, 2004

5. Jamieson D. ‘Targeting and Achieving Lower Cost Liquefaction Plants‘, LNG12, May 1998

6. Andress D. ‘The Phillips Optimized Cascade LNG Process – A Quarter Century of Improvements‘, 1996

7. Hunter P., Andress D. ‘Trinidad LNG – The Second Wave‘, GasTech 2002

8. ‘GE Energy Completes First Phase of Upgrade Project at Trinidad LNG Plant’, GE Newsroom Website, 24 January 2004

9. ‘Camfil Annual Report 2012’, Camfil Farr Belgium Website, 2012

10. ‘Atlantic Sustainability Report 2017’, Atlantic LNG Website, 2017

11. Raymer S. et al ‘Revolutionizing Gas Turbine Maintenance in LNG Service‘, ASME Turbo Expo 2005

12. ‘History’, Atlantic LNG Website

13. ‘Amoco’, British Petroleum Website

14. ‘SUEZ Group History’, Ondeo Czech Website

15. El-Khelaly M ‘Tractebel to buy Cabot LNG for $680 million’, Oil & Gas Journal Website, 13 July 2000

16. ‘Chinese Firm Takes Over Share in Atlantic LNG’, E&P Magazine Website, 19 December 2011

17. ‘Shell boosts its leadership in global LNG with the completion of Repsol S.A. LNG deal’, Shell Global Website, 2 January 2014

18. ‘Combination BG Group publications’ Shell Global Website

19. ‘More details on ALNG explosion revealed – investigation underway’, Gas Strategies Website, 15 June 2004

20. Yates D. et al ‘The Darwin LNG Project’, ConocoPhillips Website, 2004