In 2002, CMS Energy’s stake in the Alba fields was acquired by Marathon Oil Corporation and triggered off the plan to monetize the field’s gas through LNG exports. The Equatorial Guinea LNG plant (aka Punta Europa) on Bioko Island near the capital city of Malabo, boasts of the quickest transition from initial concept to FID in 2004. The work-site, 60 m above the ocean, is connected by a unique 330 m steel suspension bridge, built over moist and unstable soil of the rain forest. In 2007 BG Gas Marketing signed a 17-year purchase and sale agreement for LNG from the facility. First delivery from the $1.4billion plant was made in May 2007, prompting strong interest to add a second train of 4.4 MMTPA capacity.

However, dwindling supply from the Alba field threatened full capacity utilization of the existing plant for the remainder of its design life. The expansion plans for the second train and a possible third train are entirely dependent on sufficient long-term gas resources (arguably from neighbouring countries) and the right market conditions. In May 2018 Noble Energy signed an agreement with the Equatorial Guinea government to supply gas from the Alen field to the EG LNG plant.

EG LNG has initiated social initiatives across the country, which include 35 water well projects, 10 new primary schools, computer laboratory program across multiple secondary schools and the Centro de Salud medical center in the country‘s capital Malabo. The project has demonstrated strong intent to hire local workforce and has accomplished a great deal in the local community through its efforts to build national content, which includes initiatives to build capacity of local vendors and contractors.

OWNERSHIP (Equity %)

| Government of Brunei | 35.50% |

| Shell Overseas Holdings Limited | 25.00% |

| Mitsubishi Corporation | 25.00% |

General Data

| Estimated Capital Cost (USD) | 1.4 B |

| Plant Type | Onshore Stick-built |

| Plant Stage | Operating |

| Final Investment Decision (FID) Year | 2004 |

| FEED Contractor | WorleyParsons |

| EPC Contractor | WorleyParsons JGC Corporation |

| No. of Trains / capacity | 1 Train / 3.7 MMTPA |

| Production Start Year | 2007 |

| Products | Propane, LPG, Condensate |

| Gas Type | Non-associated Gas (NAG) |

Technical Data

| Cooling Media | Air |

| Liquefaction Technology | CoP Optimized Cascade® |

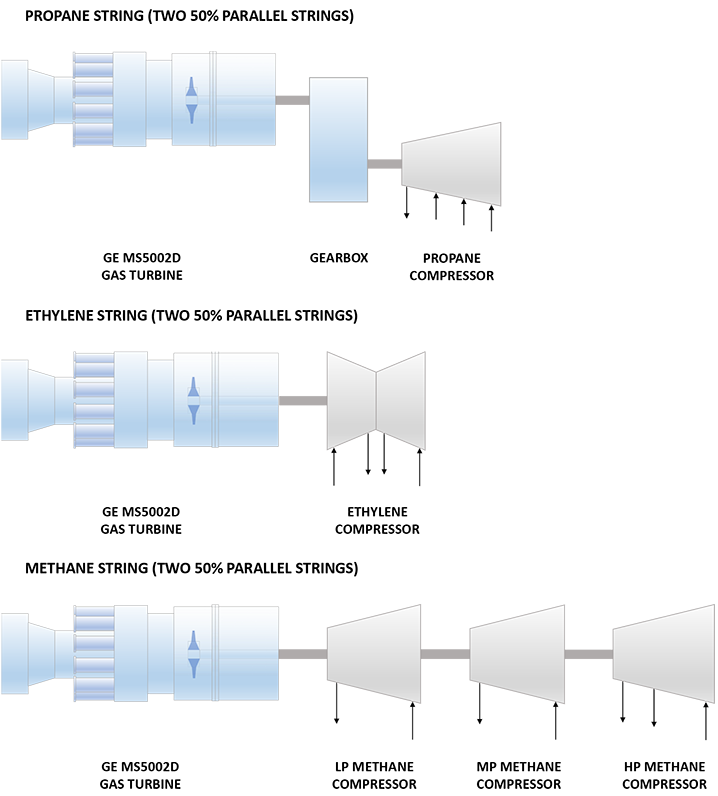

| Refrigeration Train Details: | |

| Propane Strings 1 & 2 | |

| Driver | GE MS5432D (Frame 5D) Heavy Duty Gas Turbine |

| Double Helical speed reduction gearbox | |

| Propane Compressor | 3MCL1405 GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor |

| Ethylene Strings 1 & 2 | |

| Driver | GE MS5432D (Frame 5D) Heavy Duty Gas Turbine |

| Ethylene Compressor | GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor (2MCL) |

| Methane Strings 1 & 2 | |

| Driver | GE MS5432D (Frame 5D) Heavy Duty Gas Turbine |

| Low Pressure (LP) Methane Compressor | GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor (MCL) |

| Medium Pressure (MP) Methane Compressor | GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor (MCL) |

| High Pressure (HP) Methane Compressor | GE (Nuovo Pignone) Radially Split Centrifugal Compressor (3BCL) |

| Power Generation | 2 x GE Frame 5 Gas Turbine Generators |

Refrigeration Train Configuration

Key Facts

- The EGLNG plant receives feed gas from the Alba gas field, with its 3 trillion cubic feet reserves sufficient to cater to only 12.5 years of the 17 year supply agreement with BG. As the supply starts to significantly dip in 2019/2020, the plant will have to accumulate supply from stranded gas fields in Equatorial Guinea and the wider region.1

- The 17 year purchase deal signed by BG Group (now Shell) with EGLNG, was agreed with a fixed discount on the Henry Hub prices, as the LNG was originally meant for US markets. However, sharp decline in US linked prices, on account of the shale revolution, allowed LNG exports from EGLNG to be diverted to Asian markets at up to 5 fold pricing.1

- In May 2018, an agreement was signed with Noble Energy to supply gas to EGLNG from the 600-billion-cubic-feet offshore Alen field.1

- In August 2006, the FEED contract for building a second train at EGLNG was awarded to Bechtel. In May 2010, the government of Equatorial Guinea claimed an increase in their gas estimates to 4.5 trillion cubic, making a strong case for a second or even a third train. However, these expansion plans are contingent on supply agreements with gas resource holders in the region, as well as possibility of pipeline imports from Nigeria and Cameroon.2

- EGLNG is one of the lowest cost LNG operations in the Atlantic basin with an all-in LNG operating, capital and feedstock cost of approximately $1 per million British thermal units at the loading flange of the LNG plant.2

- Bechtel overcame dangerous construction challenges, such as the 60m drop from the plant to the loading jetty, through dense, sloped and unstable terrain of the rain forest. They did this by constructing a 330m steel suspension bridge, that carries 76 cm diameter export and vapor return pipelines with utilities, as well as a walkway from the top of the bridge down to the LNG loading platform.2

- The 17-year SPA with Shell will soon come to the end of its term. Equatorial Guinea is already looking for new buyers for its LNG from 2020 onwards and is in talks to close deals with various players for 3 to 5 years terms.3

- The jetty at EGLNG does not have a protective breakwater, as it is naturally protected against swells by the southern tip of Malabo Island. The absence of a breakwater necessitates the orientation of the loading platform parallel to the trestle, such that the bow of the ship faces the oncoming waves, thereby reducing the motion of the ship.4

Source:

1. ‘Equatorial Guinea in LNG sale talks as Shell deal winds down’, Reuters Website, 10 May 2018

2. ‘Equatorial Guinea LNG Project, Bioko Island, Punta Europa’, Hydrocarbons Technology website

3. ‘Equatorial Guinea seeking LNG buyers post 2020 ‘, LNG World News website, 11 May 2018

4. ‘Challenges Ahead at Equatorial Guinea – Execution of a grassroots LNG project on Malabo Island’, by Devendra Agrawal, GasTech 2005, March 2005