Queensland Gas Company Ltd (QGC) was a wholly owned subsidiary of the BG Group since November 2008. The BG Group was in turn acquired by Royal Dutch Shell in February 2016. QGC operates the Queensland Curtis LNG project, which received Final Investment Decision (FID) in October 2010, after acquiring Australian Federal Government’s conditional approval to harness Coal Seam Gas (CSG) in Central Queensland. CSG is the methane gas formed and trapped within coal, created through geological heating and compression of plant matter over millions of years.

In March 2010, BG Group signed 20-year Sale Purchase Agreements (SPA) with Tokyo Gas for 1.2 MMTPA of LNG and with CNOOC for 3.6 MMTPA of LNG, both with starting dates in 2015. This was followed with signing of a 21-year SPA with Chubu Electric in May 2011 and separate agreements with GNL Chile and the Energy Market Authority of Singapore. A 270-hectare site was selected at the North China Bay on Curtis Island, Gladstone, Queensland to build the LNG plant. Curtis Island is home to 3 LNG plants – Australia Pacific LNG, Gladstone LNG and Queensland Curtis LNG, which together represent investments of over $70 billion.

Construction of phase 1 of the project began in late 2010, including 2 LNG trains, gas pre-treatment facilities, a nitrogen reinjection unit and two 140,000 cubic metre LNG storage tanks. The plant started production from the first train in December 2014 and became the first project worldwide to export LNG out of CSG. Commercial production started in May 2015, while the second train came on stream later the same year, making the combined nameplate capacity 8.5 MMTPA. The facility has ample provision to add a third train and expand the plant capacity to over 12 MMTPA.

The plant receives CSG through a 340-kilometre underground pipeline from Surat Basin in Southern Queensland. Almost 6000 gas production wells will be harnessed by the project through its lifespan. The company also supplies gas to Australian customers and fulfils more than 10% of east coast gas demand and 40% of Queensland demand. In 2017, Australia built up an LNG export capacity of approximately 44 MMTPA and claimed the status of 2nd largest exporter of LNG after Qatar.

In the recent years abundant availability of gas has triggered off multiple plants being commissioned in United States and several other countries worldwide. This has led to oversupply in the LNG market, which when compounded with the high capital costs of Australian LNG plants and the excessive operating costs of the CSG fields, has raised serious questions on the competitiveness of LNG exports from Gladstone.1 Depletion of traditional east coast reserves, which catered to the domestic gas demand, now threatens diverting CSG from export to domestic use.2 In July 2017, the Australian Government introduced the Australian Domestic Gas Security Mechanism (ADGSM), which has the power to restrict LNG exports from Gladstone to protect local supply.3

In 2015-16 financial year the company spent $3.9 billion with Australian businesses and together with its contractors employed 4247 personnel, primarily based out of Queensland. QGC promises to benefit its host community by investing in STEM Education (Science, Technology, Engineering and Math), Enterprise Development and Community Development. This includes programs such as the economic diversification programs with Toowoomba Surat Enterprise Basin (TSBE) that support regional Queensland small businesses and work with agriculture producers to expand into international markets. The company also funds grassroots community initiatives through the QGC Communities Fund and Sponsorship and Donations program, which cover activities such as Sport & Recreation, Education, Environment and Arts & Culture.

Queensland Curtis LNG is committed to sustainable development and respecting the environment. The company has invested in excess of A$2 billion on water-related treatment infrastructure, research, modelling, monitoring and management. Since 2014, two water treatment plants have been operational, delivering 65 mega litres of treated water per day (average in 2016) into two major irrigation schemes on the Condamine and Dawson Rivers. In addition, the company has various environmental management plans approved by the Department of Environment (DoE), including plans for nature conservation, air quality, waste management, noise, flaring, as well as long-term turtle management.

OWNERSHIP (Equity %)

| Train 1 | |

| Shell | 50.00 % |

| CNOOC | 50.00 % |

| Train 2 | |

| Shell | 97.50% |

| Tokyo Gas | 2.50% |

General Data

| Estimated Capital Cost (USD) | 3 B Per Train |

| Plant Type | Onshore Modular |

| Plant Stage | Operating |

| Final Investment Decision (FID) Year | 2010 |

| FEED Contractor | Bechtel |

| EPC Contractor | Bechtel |

| No. of Trains / capacity | 2 Trains / 4.25 MMTPA each |

| Production Start Year | 2014 (Train 1) 2015 (Train 2) |

| Products | LNG |

| Gas Type | Coal Bed Methane (CBM) |

Technical Data

| Cooling Media | Air |

| Liquefaction Technology | CoP Optimized Cascade® |

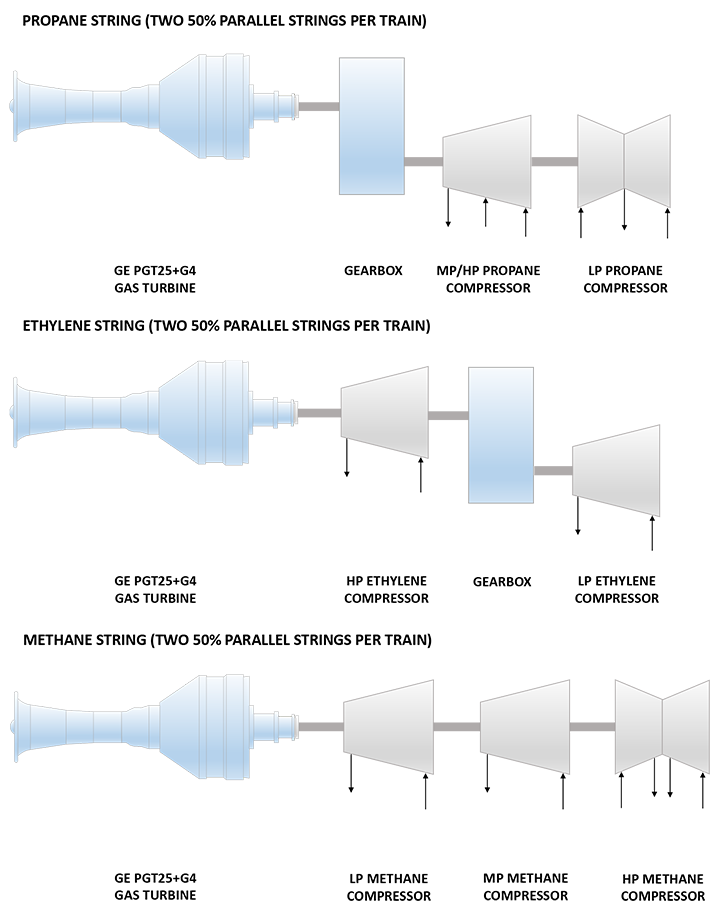

| Refrigeration Train Details: | |

| Propane Strings 1 & 2 | |

| Driver | GE PGT25+G4 DLE Aeroderivative Gas Turbine |

| Gearbox | Double Helical Speed Reduction Gearbox |

| Medium Pressure (MP)/ High Pressure (HP) Propane Compressor | 3MCL1002 GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor |

| Low Pressure (LP) Propane Compressor | DMCL1004 GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor |

| Ethylene Strings 1 & 2 | |

| Driver | GE PGT25+G4 DLE Aeroderivative Gas Turbine |

| High Pressure (HP) Ethylene Compressor | MCL803 GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor |

| Gearbox | Double Helical Speed Reduction Gearbox |

| Low Pressure (LP) Ethylene Compressor | MCL1404 GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor |

| Methane Strings 1 & 2 | |

| Driver | GE PGT25+G4 DLE Aeroderivative Gas Turbine |

| Low Pressure (LP) Methane Compressor | MCL806 GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor |

| Medium Pressure (MP) Methane Compressor | MCL806 GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor |

| High Pressure (HP) Methane Compressor | 2BCL607 GE (Nuovo Pignone) Radially Split Centrifugal Compressor |

| Power Generation | 3 x PGT25+G4 DLE Gas Turbine Generators |

Refrigeration Train Configuration

Key Facts

- In July 2013, Santos, operator of the Gladstone LNG project, and BG Group subsidiary QGC (now Shell), which operates the Queensland Curtis LNG project, agreed to connect the two pipelines that feed their plants to provide enhanced flexibility during the projects’ lifetimes. The interconnect will allow flow of gas between the projects when required, maximizing plant productivity, especially during scheduled and unscheduled down times.4

- In November 2018, Queensland Curtis LNG and Australia Pacific LNG agreed to share infrastructure in gas supplies by way of a tolling agreement commencing from 2020 to 2035 with a possible extension till 2049.5

- Due to fluctuating ambient air temperature ConocoPhillips integrated inlet air chilling to their PGT25+G4 gas turbines in order to improve the LNG production at QCLNG. QCLNG is not only the first LNG plant in the world to use a gas turbine with inlet air chilling but also incorporates the use of a warm nitrogen rejection unit (NRU).6

- Queensland Curtis LNG (QCLNG), Gladstone LNG (GLNG) and Australia Pacific LNG (APLNG) were constructed simultaneously at Curtis Island. However, QCLNG became the first LNG plant in the world to use the unconventional Coal Seam Gas (CSG) as feedstock for processing into LNG. Coal Seam Gas (CSG), also known as Coal-Bed Methane (CBM) or Coal-Mine methane (CMM), is a natural gas extracted from coal beds.7

- The three plants at Curtis Island – Queensland Curtis, Gladstone and Australia Pacific LNG – cost comparatively lower than the three LNG plants built in North-Western Australia – Gorgon, Ichthys and Wheatstone. The final investment decision of the plants in Queensland were made successively one year after another, with Queensland Curtis in 2010, Gladstone in 2011 and Australia Pacific LNG in 2012. Accordingly, the plants started production in 2014, 2015 and 2016 respectively. This offered a better economy of scale, and brought down the cost for a single unit to USD 1300-1400/TPA, compared to the prevailing cost of USD 1500-1600/TPA in Australia. Some factors that contributed to the cost reductions include8:

> Locational advantage

> Innovative modularization

> Close proximity and good cooperation between the plants

> Lean coal seam feed gas.

> Economies of scale: Sharing a common contractor (Bechtel) and process technology.9 - The QCLNG project was built to last for 20 years with 6000 gas wells in total to be drilled for two trains at an estimated coal bed methane (CBM) reserves of 7 trillion cubic feet.10

- In early 2013, GE signed a USD 620 million, 22-year Contractual Service Agreement (CSA) for planned and unplanned maintenance as well as monitoring and diagnostic services and reliability solutions for the installed GE equipment.11 This includes GE’s first deployment of its ReliabilityMax predictive maintenance solution for aero-derivative gas turbines used in LNG applications.12

- QCLNG is an onshore modular plant and includes a total of 80 pre-fabricated modules, fabricated by Bechtel Australia in Thailand. The largest module – the Propane Chiller 101JA is 29 metres high and 31 metres wide.13,14

- In late 2014, QCLNG produced its first LNG from train 1. Maiden cargo was shipped to Tokyo Gas’ Sodegaura terminal aboard “Methane Rita Andrea” in January 2015. The first cargo from train 2 was shipped in July 2015 aboard “Maran Gas Posidonia”.15,16,17

Source:

1. Robertson B. ‘Australia’s Export LNG Plants at Gladstone: The Risks Mount’, Institute for Energy Economics and Financial Analysis Website, June 2017

2. Browne N. ‘LNG Changes Everything For Australia’s East Coast Gas Market’, Forbes Website, 12 July 2018

3. ‘Australian gas shortages loom as LNG exporters and domestic consumers compete for supply’, Wood Mackenzie Website, 11 September 2018

4. ‘Santos GLNG and QGC sign industry collaboration deal’, Santos Website, 4 July 2013

5. ‘Australia Pacific LNG to share infrastructure and secure additional gas supply to diversify portfolio’, Australia Pacific LNG Website, 5 November 2018

6. ‘ConocoPhillips LNG – Our technology and expertise are ready to work toward your LNG future today’, ConocoPhillips Website, 2018

7. Margolis Z., Hough C. ‘Queensland company to be first in the world to export LNG from coal seam gas’, Australian Broadcasting Corporation Website, 29 December 2014

8. Songhurst B. ‘LNG Plant Cost Reduction 2014–18’, Oxford Institute for Energy Studies OIES Paper: NG137, October 2018

9. ‘Curtis Island LNG, Queensland, Australia’, Bechtel Website

10. Kelly L. ‘Australia’s Emerging CBM LNG Industry’, Japan Oil, Gas and Metals National Corporation (JOGMEC) Website, January 2011

11. ‘GE awarded US$ 620m services contract in Australia’, Turbomachinery Mag Website, 25 March 2013

12. ‘GE Deploying ReliabilityMax Maintenance Solution at QCLNG Plant’, LNG World News Website, 3 February 2014

13. ‘BG Group: First QCLNG Modules Arrive in Gladstone’, LNG World News Website, 21 August 2012

14. ‘Australia: Last QCLNG Module Arrives at Curtis Island’, LNG World News Website, 30 October 2013

15. Dodson S. ‘First cargo from QCLNG project in Australia’, World Coal Website, 2 January 2015

16. ‘Tokyo Gas receives first QCLNG Shipment’, LNG World News Website, 2 April 2015

17. Wilson S. ‘BG Group loads first LNG cargo from Australia’s QCLNG Train 2’, S&P Global Platts Website, 13 July 2015