Tangguh, literally meaning resilient in Indonesian language, is the name given to the 18.3 trillion square feet mammoth gas reserves in the province of West Papua in Indonesia. In 1994, gas was discovered in the region by ARCO, prompting a proposal in 1997, to monetize the reserves by constructing an LNG export facility in Bintuni Bay. The project signed its first sale and purchase agreement (SPA) in September 2002 with China’s CNOOC for supplying 2.6 MMTPA of LNG for 25 years. Subsequently, 20-year SPAs were signed with K-power and POSCO in 2003 for export to Korea and Sempra Energy in 2004 for US and Mexican markets.

Construction on the 3200-hectare land began in 2005, with 80 hectares used for the facility housing 2 LNG trains of a combined capacity of 7.6 MMTPA. Commercial production suffered delays on account of logistical and financial causes. In June 2009, the first train started production with the second train coming onstream later in the year. It took 2 years for the plant to rev-up to 100% capacity due to several reasons, including design flaws and optimization complexities.

The BP operated plant exports LNG and condensate consuming gas from multiple fields, including Vorwata, Wiriagar Deep, Ofaweri, Roabiba, Ubadari, and Wos. With abundant supply options as well as availability of land, the project has the capability to expand to 8 LNG trains. In July 2016, FID for adding a third train was reached. The additional capacity of 3.8 MMTPA is expected to come onstream in 2020.

The Tangguh Sustainable Development Program (TSDP) aims at enhancing the quality of life of the local community through participation, accountability and sustainability. It focusses on various programs, including Education, Governance, Health, Local Economic Development, Workforce Relations & Papuan Development, Environmental Protection & Awareness, Integrated Community-Based Security, Tangguh Sustainability Projects, Community & External Relations. Since 2000, engineers were recruited from local community and trained for working on the Tangguh project. At full capacity the plant needs over 500 personnel. 112 Papuan youths are currently attending the Tangguh Technician Apprentice Programme, to fulfil the project’s target of employing 85% Papuan workforce by 2029. The Tangguh expansion project is expected to generate over 10,000 jobs during the construction phase.

The project claims to have a green design which mitigates NOx and CO2 emission. The facility has combine-cycle power generation, which also supplies electricity to the local region, thereby drastically cutting down traditional dependence on diesel generators. Only 2.5% of the land acquired has been used for the LNG plant, the remainder is mainly left as an environmental green zone.

OWNERSHIP (Equity %)

| Train 1 & 2 | |

| BP | 40.22% |

| MI Berau B.V. (Mitsubishi / INPEX) | 16.30% |

| CNOOC | 13.90% |

| Nippon Oil | 12.23% |

| KG Companies | 10.00% |

| Indonesia Natural Gas Resources | 7.35% |

| Train 3 | |

| BP | 37.16% |

| MI Berau B.V. (Mitsubishi / INPEX) | 16.30% |

| CNOOC | 13.90% |

| JX Nippon Oil & Energy | 12.23% |

| KG Companies | 10.00% |

| Indonesia Natural Gas Resources | 7.35% |

| Talisman Wiriagar Overseas Ltd. | 3.06% |

General Data

| Estimated Capital Cost (USD) | Train 1 & 2 : 5 B Train 3 : 8 B |

| Plant Type | Onshore Stick-built |

| Plant Stage | Trains 1 & 2 - Operating Train 3 - Construction |

| Final Investment Decision (FID) Year | Train 1 & 2 – 2005 Train 3 – 2016 |

| FEED Contractor | Train 1 & 2 Chiyoda Corporation Train 3 Chiyoda Corporation PT Tripatra Indonesia Saipem PT Suluh Ardhi Engineering Rekayasa Industri JGC Corporation KBR Indonesia |

| EPC Contractor | Train 1 & 2 M. W. Kellogg Limited (now KBR) JGC Corporation PT Pertafenikki Train 3 Chiyoda Corporation Saipem PT Tripatra Indonesia PT Suluh Ardhi Engineering (SAE) |

| No. of Trains / capacity | 3 Trains / 3.8 MMTPA each |

| Production Start Year | 2009(Train 1) 2010 (Train 2) 2020 (Train 3) |

| Products | LNG |

| Gas Type | Non-associated Gas (NAG) |

Technical Data

| Cooling Media | Air |

| Liquefaction Technology | APCI AP-C3MR/SplitMR® |

| Refrigeration Train Details: | |

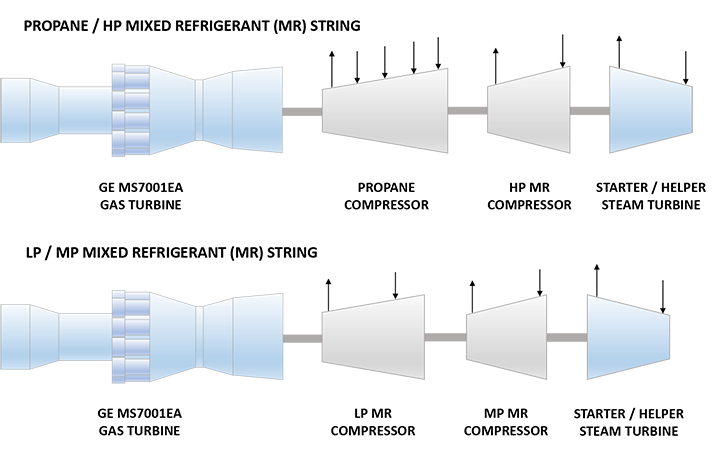

| Propane – HP Mixed Refrigerant (MR) String | |

| Driver | GE MS7121EA DLN1 (Frame 7EA) Heavy Duty Gas Turbine |

| Propane Compressor | 3MCL1405 GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor |

| High Pressure (HP) MR Compressor | BCL804 GE (Nuovo Pignone) Radially Split Centrifugal Compressor |

| Starter/Helper | NG63/50 GE (Nuovo Pignone) Steam Turbine |

| LP – MP Mixed Refrigerant (MR) String | |

| Driver | GE MS7121EA DLN1 (Frame 7EA) Heavy Duty Gas Turbine |

| Low Pressure (LP) MR Compressor | AN250 (First LNG application) GE (Nuovo Pignone) Axial Compressor |

| Medium Pressure (MP) MR Compressor | MCL1002 GE (Nuovo Pignone) Horizontally Split Centrifugal Compressor |

| Starter/Helper | NG50/40 GE (Nuovo Pignone) Steam Turbine |

| Power Generation | 3 X 35 MW Steam Turbine Generators |

Refrigeration Train Configuration

Key Facts

- The Tangguh plant uses a combination of steam and gas turbines and electric motors.1

- The Frame 7EA industrial gas turbines are coupled with Heat Recovery Steam Generators (HRSG) in a deep combined cycle configuration. This facilitates extensive waste heat recovery and supplies 27% of plant’s total energy demand.2

- Tangguh LNG Train 1 began production in mid-June 2009. In July 2009, Tangguh Foja LNG carrier carried the first cargo produced from Train 1 to POSCO’s LNG regasification terminal in Gwangyan in South Korea. 3

- The phase 1 of the facility includes two unmanned platforms with 14 wells, two 3.8 MMTPA LNG trains, two 170,000 m3 LNG tanks, one 120,000 bbl Condensate tank and three 35MW Steam Turbine generators.4

- In the very first year of operation the plant struggled through a series of design problems. Over 25 major modifications and repairs were executed to overcome these issues. Some of the turbo-machinery related issues were:4

> Hot air recirculation problem in refrigeration unit, which required AFC Motor replacements, pressure release valve (PRV) resetting and HAR shielding

> Dry gas seal problems in refrigeration

> Turbo expander manufacturing defect

> Boil-off gas (BGS) Dry gas seal (DGS) problem - The plant also faced issues in the scrub column design, which couldn’t support wide range of feed gas compositions, including extreme lean feed gas. Several design modifications were implemented in the scrub column to overcome these problems..4

- The construction of the Tangguh Expansion Project includes an LNG process train, LNG storage tank, Condensate storage tank, utilities such as steam, air nitrogen etc, fresh water supply system, Flare, Power generation and solid and wastewater disposal system. The propane and mixed refrigerant compression system in the Tangguh Expansion Project consists of two main refrigeration compressors, which are driven by two GE Frame 7 gas turbines.5

- The Tangguh Expansion Project employs 3 additional 35 MW steam turbine generators (STGs) to supply power required for the project operation. The STGs run at 11 kV, 3 phase, 50 hertz and the voltage is stepped-up to 33 kV for distribution.5

- In November 2006, a fire broke out due to overheating, causing shut down of Train 2, BP restarted Train 2 operations in December 2012.6,7

- In 2014, Indonesia recorded its biggest ever gas sales agreement for the domestic market, contributing a state revenue of $10.5 billion. Perusahaan Listrik Negara (PLN) agreed to purchase approximately 400 cargoes of LNG from the Tangguh plant over 19 years.8

- The project obtained ISO14001 certification in December 2010 and is on track to deliver its AMDAL (environmental and social impact assessment) commitments.9

- The project is the world’s first integrated LNG operation that combines both upstream and downstream activities, covering offshore gas production, gas processing and liquefaction, as well as shipping to international markets. Following the 1997 Asian Financial Crisis, the project emerged as Indonesia’s largest foreign direct investment.9

- In 2014, BP awarded FEED contract to two consortia for Tangguh Expansion Project. The first group included Tripatra Engineers and Constructors, Triparta Engineering, Chiyoda International Indonesia, Saipem Indonesia, Suluh Ardhi Engineering and Chiyoda Corporation Consortium. While the second group included Rekayasa Industri, JGC Corporation, KBR Indonesia and JGC Indonesia Consortium.10

- In 2016, BP revised its investment budget for the Tangguh Expansion Project down to $8 billion, from the initially estimated $12 billion. This was due to declining oil prices at that time which allowed BP to adjust their EPC services.11

- The Tangguh Expansion Project not only involves addition of a third LNG production train but also the construction of a combined LNG and condensate jetty, an expanded LNG loading facility and other supporting infrastructure. Two platforms, production and exploration wells, infill wells and subsea pipelines will be added to the offshore facilities, while onshore additions will include an enhanced receiving facility, a condensate stabiliser column and a condensate product cooler. New utilities additions will include water supply, wastewater treatment, power supply, offices and accommodation facilities. The plant will possess the capability to process both lean and rich condensate, and carbon dioxide.12

- The Tangguh Expansion Project will play an important role in supporting Indonesia’s growing energy demand, with 74% of the Train 3 annual LNG production sold to the Indonesian state electricity company PT. PLN (Persero). The remaining 26% is contracted to Kansai Electric Power Company in Japan, the other foundation buyer for Train 3.13

Source:

1. Songhurst B. ‘LNG Plant Cost Reduction 2014–18’, Oxford Institute for Energy Studies OIES Paper: NG137, October 2018

2. Phillips III R. et al ‘Tangguh LNG – Energy Efficiency Measures through Life Cycle Cost Analysis’, GasTech 2005, Bilbao, Spain, March 2005

3. ‘First Cargo from Indonesia’s Tangguh LNG Project’, Inpex Corporation Website, 6 July 2009

4. Samsu D., Supriyadi PD. ‘Resilient Operations to Deliver Energy’, SKK Migas Indonesia Website, 26 October 2016

5. ‘ANDAL For Integrated Activities of The Tangguh LNG Expansion Project’, Japan Bank for International Cooperation Website

6. ‘Indonesia’s Tangguh LNG train 2 shut down after overheating-Regulator’, Reuters Website, 10 November 2012

7. ‘BP Restarts Tangguh Train 2’, LNG World News Website, 11 December 2012

8. ‘PLN inks Tangguh LNG deal with BP’, LNG World News Website, 17 October 2014

9. ‘Loan Indonesia: Tangguh Liquefied Natural Gas Project | Project Number: 38919 | Reference Number: LN 2214/EI7224’, Asian Development Bank Website, November 2012

10. Harris P. ‘BP awards FEED contracts for third train of Tangguh LNG project in Indonesia’, Oil & Gas Technology Website, 22 October 2014

11. ‘Energy Indonesia: BP to Invest in Tangguh Expansion Project (Train 3)’, Indonesia Investments Website, 4 July 2016

12. ‘Tangguh LNG Expansion Project, Papua Barat Province’, Hydrocarbons Technology Website

13. ‘Tangguh LNG Expansion Project (Train 3)’, Chiyoda Corporation Website